This website provides test asset returns and signals replicated from the academic asset pricing literature. If you use the data, please cite our paper:

@article{ChenZimmermann2022,

title={Open Source Cross-Sectional Asset Pricing},

author={Chen, Andrew Y. and Tom Zimmermann},

journal={Critical Finance Review},

year={2022},

volume={27},

number={2},

pages={207--264}

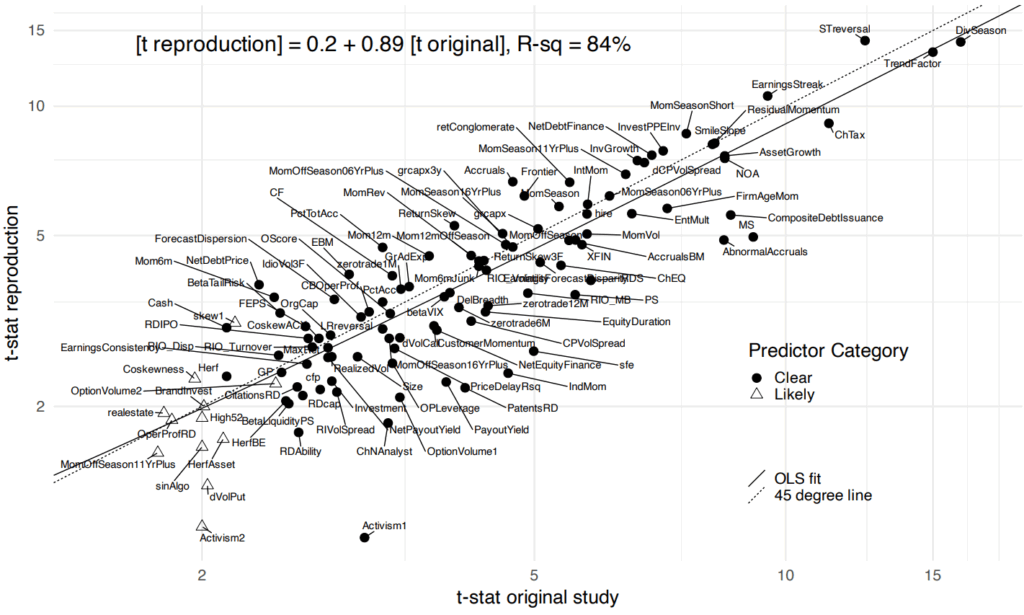

}Here is a comparison of t-statistics in published studies against our replication: